Financial market liquidity is often mentioned in the field of electronic trading, because asset liquidity is an important indicator of how the trading market is performing. Today, let’s take a look at what liquidity really is and which indicators can affect the market liquidity.

Definition Of Liquidity

First, let’s understand the definition of financial market liquidity: Liquidity refers to the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price. In other words, market liquidity refers to a market’s ability to allow assets to be bought and sold easily and quickly.

The one of the main components of the financial market liquidity are financial assets. Financial assets are usually categorized as traditional financial assets. For example, the Fortex XForce e-trading platform connects traditional financial assets such as stocks, futures, foreign exchange, metals, energy, commodities, supporting 10,000+ product transactions around the world.

Key Indicators that measure Liquidity

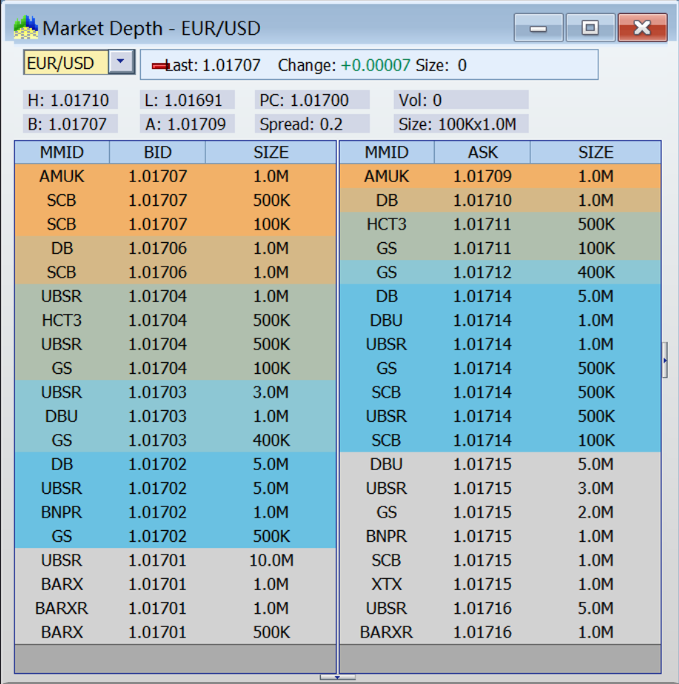

Market Density:Market density refers to the divergence between the transaction price and the market price, which is measured by quoted spread.

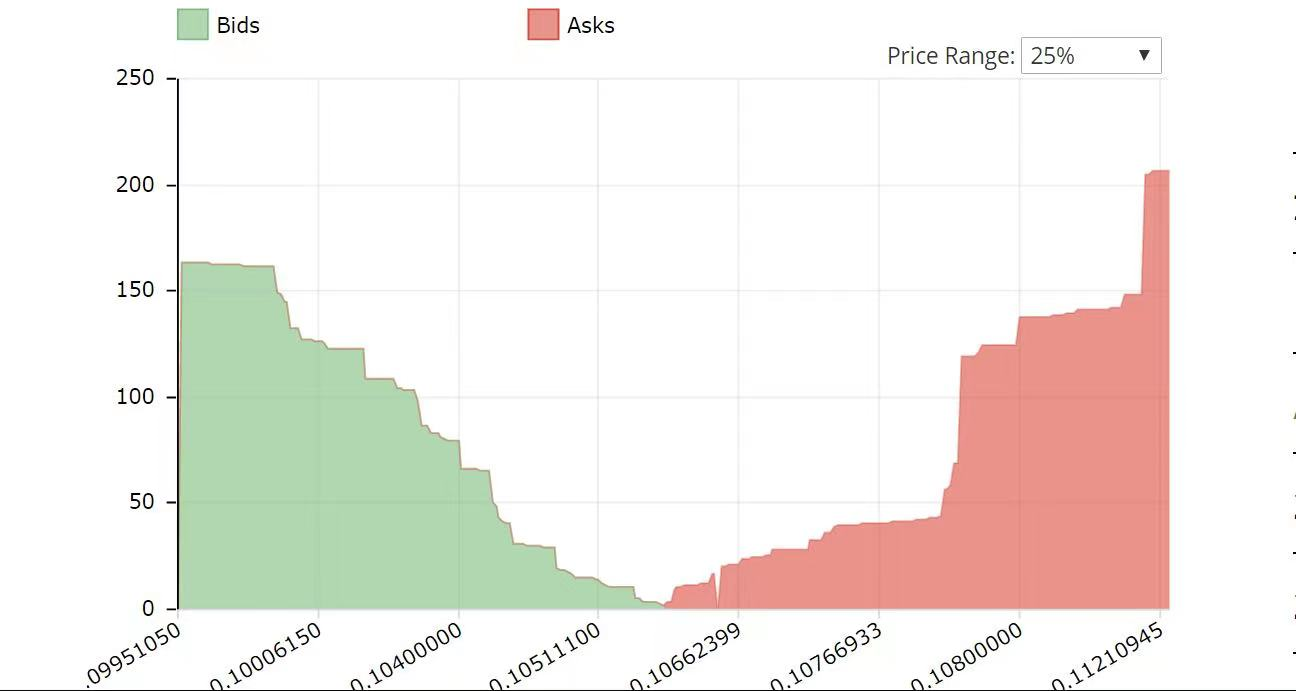

Market Depth:Market depth refers to the tradeable volume at the markets at the particular moment.

Market Resilience:Market resilience refers to the speed at which price fluctuations caused by trading return to equilibrium. It is usually the speed at which the normal market conditions (trading spread, trading volume) returns to normal after observing a big transaction.

Moreover, the liquidity of financial markets depends on the relative forces between buyers and sellers and between the amount of capital to buy and the number of assets available, and is determined by the amount of trading funds supplied in the entire market relative to financial assets.

Therefore, to determine whether an e-trading platform has good market liquidity, it will depend on whether the liquidity has good market density, market depth, market elasticity. It also depends on the aggregation capacity of the platform’s electronic trading assets. Aggregation capabilities depend on whether this electronic trading platform can provide powerful trading functions, stable and accurate market quotes, and the ability to aggregate the most realistic liquidity.

As the world’s leading multi-asset electronic trading solution provider, Fortex has built an open, neutral and diversified Fortex electronic trading ecosystem, connecting the liquidity and depth of 500+ industry giants around the world, including banks, liquidity providers, brokerage dealers, asset management companies, and hedge funds.

The Fortex XForce e-trading platform, as a core component of the Fortex electronic trading ecosystem, can help institutional customers complete complex transactions with different market participants. It can help institutional customers access and manage liquidity, carry out liquidity distribution, risk management, order matching and management, account system management, and provide clearing and settlement technology.

Please Leave your message to https://www.fortex.com/en/contact/

About Fortex

Founded in 1997, Fortex Technologies aims to revolutionize trading with its powerful, neutral, multi-asset trading platform focused on the FX, and equities markets. Fortex’s XForce solution, ECN, MT4/5 bridges, infrastructure hosting and more are used by regional banks, hedge funds, asset managers, broker dealers and professional traders around the world to enhance liquidity access, improve execution workflows and support sophisticated trading strategies.